Comprehensive Travel Insurance Guide for Seniors: Medical Coverage Tips

Travel insurance is essential for seniors seeking peace of mind during their adventures.

Why Travel Insurance is Crucial for Seniors

As life's journey progresses, medical issues can become more prevalent. For seniors, comprehensive travel insurance ensures that medical emergencies abroad do not result in financial ruin or logistical nightmares. Here's why it's essential:

1. Coverage for Medical Emergencies

Unforeseen medical situations can arise at any moment, especially when traveling. Senior travelers might face higher risks due to age-related health problems, making travel insurance with robust medical coverage indispensable. Policies typically cover doctors' visits, hospital stays, surgeries, and emergency evacuations.

2. Pre-Existing Conditions

For many seniors, managing pre-existing medical conditions is part of daily life. Travel insurance can sometimes cover these conditions, ensuring you get the necessary care without exorbitant costs. Always disclose any pre-existing conditions to your insurer to determine the coverage available.

3. Trip Cancellations and Interruptions

Seniors may need to cancel or interrupt their trips due to health concerns. Travel insurance often reimburses for non-refundable travel costs if an unavoidable situation arises, such as severe illness or injury, making it a financial safeguard.

Choosing the Right Travel Insurance for Seniors

When shopping for travel insurance, several factors should guide your decision, including coverage limits, exclusions, and premiums. Here are tips to help you select the top policy:

1. Evaluate Medical Coverage Limits

Medical care costs can be prohibitively expensive, especially abroad. As seniors are more likely to require medical attention, a higher coverage limit for medical expenses is advised. Policies with at least $100,000 in medical coverage are ideal.

2. Check for Emergency Evacuation Coverage

In case of severe medical emergencies that local facilities cannot handle, medical evacuation might be necessary. This can be extremely costly, so ensure your policy includes ample coverage for emergency evacuations—typically at least $250,000.

3. Understand Exclusions and Limitations

Not all policies are created equal, and some have significant exclusions, especially concerning pre-existing conditions. Carefully read the policy documents to understand what's covered and what's not. Some policies offer waiver options to include pre-existing conditions.

4. Compare Premiums and Deductibles

While it's tempting to go for the low price option, remember that low premiums often come with high deductibles and limited coverage. Balance cost with the level of protection offered. Often, a slightly higher premium can provide considerably better coverage.

5. Look for Age-Specific Policies

Some insurers specialize in policies designed for seniors, incorporating benefits tailored to common needs among older travelers. These can include higher medical coverage limits, coverage for mobility aids, or enhanced customer support.

Additional Tips for Senior Travelers

Securing the right travel insurance is just one part of a successful trip. Here are some additional tips to enhance your travel experience:

1. Keep a Medical Summary Ready

Prepare a concise, written medical summary detailing your health conditions, medications, and emergency contacts. This can be invaluable in an emergency situation and ensures that healthcare providers have immediate access to crucial information.

2. Pack Medications and Supplies Smartly

Always carry an adequate supply of any prescribed medications, along with copies of your prescriptions. It's wise to pack more than you expect to need and to keep medications in their original packaging to avoid issues with customs.

3. Stay Hydrated and Rested

Travel can be physically demanding, particularly long-haul flights or busy itineraries. Keep hydrated, rest often, and don't over-schedule your days. A relaxed pace ensures you can enjoy your trip without undue stress or exhaustion.

4. Consult Your Doctor Before Travel

Check with your healthcare provider regarding any health concerns related to your travel destination. They can provide specific advice, suggest vaccinations, and ensure your health regimen is optimized for your trip.

Overall, with careful planning and the right travel insurance, seniors can navigate their travels with confidence, knowing that they're well-protected against the unexpected. Safe travels!

-

1

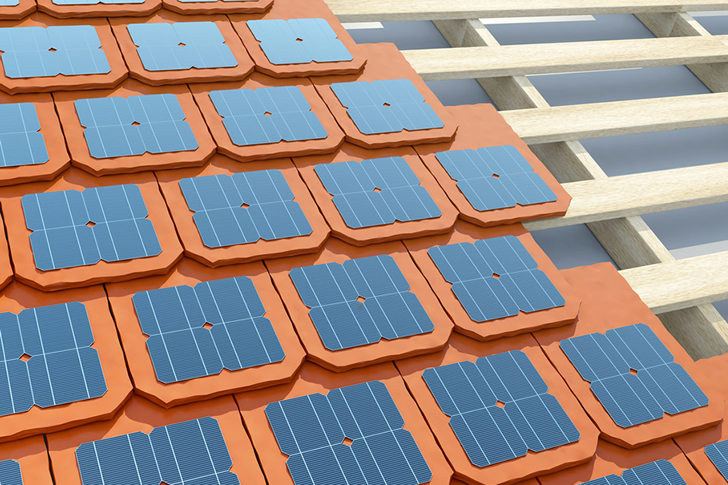

Reducing Costs and Enhancing Technology in Solar Panels

-

2

Affordable Life Insurance Options for Seniors

-

3

Comprehensive Guide to Choosing the Right Smartphone

-

4

Unlock Affordable Online Learning: A Seniors’ Guide to Economical Educational Opportunities

-

5

Discover the Keys to Landing Your Perfect Work-from-Home Job: An Essential Guide